Understanding ShariahCompliant Investments: A Guide to Ethical and Faith-Based Finance

In an increasingly diverse financial world, many individuals are seeking investments that align with their faith and values. For Muslims, Shariah-compliant investing provides a way to build wealth while adhering to Islamic principles. But what does this mean in practice, and what key terms and concepts define this ethical investment model? Let’s dive into the world of Shariah-compliant investing, exploring principles like Riba, Mudharabah, Ujrah, Wakalah, Husna, and Sukuk to help you better understand this financial approach.

What is Shariah-Compliant Investing?

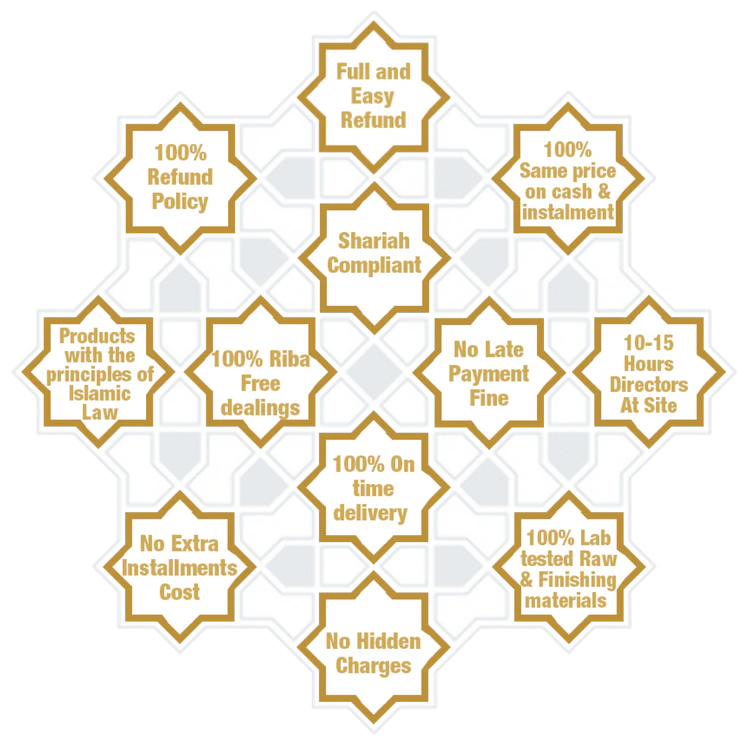

Shariah-compliant investing is an Islamic approach to finance that follows the moral and legal principles of Shariah law. This ethical framework emphasizes justice, transparency, and accountability while avoiding activities and industries deemed haram (forbidden). Shariah-compliant investing is built on several core principles:

- Prohibition of Riba (interest).

- Avoidance of unethical industries such as gambling, alcohol, and pornography.

- Promotion of profit-and-loss sharing mechanisms like Mudharabah.

- Ethical practices that ensure fairness in financial transactions.

The Pillars of Shariah-Compliant Investing

Riba (Interest)

At the heart of Shariah-compliant investing is the prohibition of Riba, or interest. Riba refers to earning money through loans or financial products where interest is charged, which is considered exploitative and unjust in Islamic finance. Instead of interest-based income, Shariah-compliant investments focus on profit-sharing models like Mudharabah, where both parties share risks and rewards.

Mudharabah (Profit-Sharing)

Mudharabah is a key concept in Islamic finance that embodies the idea of partnership. In this model, one party provides the capital while the other contributes expertise or labor. Profits are shared according to a pre-agreed ratio, while losses are borne solely by the provider of the capital unless negligence is proven. Mudharabah ensures fairness and transparency, making it a cornerstone of ethical investing.

Ujrah (Service Fees)

Ujrah refers to fees paid for services or benefits rendered. For instance, Islamic financial institutions may charge Ujrah as a management fee for administering investments or accounts. Unlike Riba, Ujrah is permissible because it represents a fair exchange of value for services provided without exploiting the client.

Wakalah (Agency)

Wakalah is an agency model where an investor appoints a financial expert or institution to act on their behalf. This ensures professional management of funds while adhering to Shariah principles. Wakalah agreements often include clear terms regarding responsibilities, fees, and objectives, promoting accountability and trust.

Husna (Kindness and Charity)

Islamic finance emphasizes Husna, which means kindness or charity. While investing, Muslims are encouraged to uphold social justice by contributing to the welfare of society. This could include investments in socially responsible projects, charitable donations, or initiatives that directly benefit underserved communities.

Sukuk (Islamic Bonds)

Sukuk are often described as the Islamic equivalent of bonds. Unlike conventional bonds, Sukuk are asset-backed and involve ownership in tangible assets or projects. Investors in Sukuk earn returns based on the performance of the underlying asset rather than fixed interest payments. This ensures compliance with the prohibition of Riba while providing a Shariah-compliant alternative for fixed-income investors.

Benefits of Shariah-Compliant Investments!

- Ethical and Moral Alignment: Investors can grow wealth while adhering to their faith.

- Promotion of Social Justice: Investments often benefit society through ethical projects and initiatives.

- Transparency and Fairness: Shariah-compliant models ensure clarity and mutual consent in all transactions.

Steps to Start Shariah-Compliant Investing

- Educate Yourself on Core Principles: Understand key concepts such as Riba, Mudharabah, Sukuk, and Wakalah to make informed decisions.

- Work with Islamic Finance Experts: Consult with advisors specializing in Shariah-compliant investments to navigate the complexities of this ethical framework.

- Choose Ethical Financial Products: Explore Shariah-compliant funds, ETFs, and Sukuk to build a balanced portfolio.

- Regular Monitoring: Ensure ongoing compliance with Shariah principles by regularly reviewing your investments.

Conclusion

Shariah-compliant investing is a powerful tool for Muslims seeking to align their financial goals with their faith. By avoiding Riba, promoting fairness through Mudharabah, leveraging services like Ujrah and Wakalah, and investing in ethical products such as Sukuk, investors can achieve both spiritual and financial success. At its core, Shariah-compliant investing is about fostering kindness (Husna), accountability, and shared prosperity.

Start your journey toward ethical and faith-based investing today by exploring these principles and working with trusted Islamic financial advisors.